Table of Contents

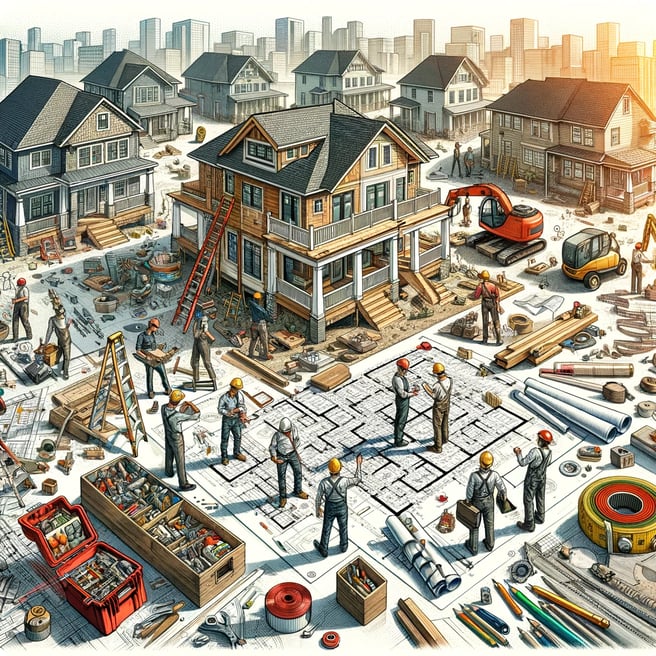

In the dynamic world of real estate, the concept of "fix and flip" has become a buzzword, synonymous with opportunity and profit. At the heart of this bustling market are fix and flip loans, a financial tool that is empowering developers and investors across America.

Red Tower Capital’s Fix and Flip Loan Program stands out as a prime example of how these loans are transforming the real estate landscape.

Rapid Financing for Quick Opportunities

In real estate, timing is everything. Fix and flip loans cater to this need for speed. Unlike traditional financing options, these loans are designed for quick underwriting and approval, enabling investors to jump on opportunities the moment they arise.

Tailored for the Experienced Investor

Red Tower Capital’s program specifically caters to experienced fix and flip developers and investors. By requiring recent flipping or real estate ownership experience, we ensure that our clients have the know-how to make the most of their investment. This focus on experience helps maintain a high success rate in the fix and flip market.

Flexible Terms and High Leverage

One of the standout features of Red Tower’s Fix and Flip Loan Program is its flexibility. Offering terms of 12, 18, and 24 months and an interest-only payment structure, it provides investors with the breathing room needed to renovate and sell properties without undue financial pressure. . Unlike traditional mortgage loans, where the terms may be rigid, fix and flip loans offer more room for negotiation and customization. This flexibility allows investors to structure the loan terms to align with their business strategy, cash flow, and expected renovation timelines.

Diverse Property Types and Competitive ARV

The program's accommodation of various property types, including single-family homes, duplexes, triplexes, and even mixed-use properties, opens doors for a wide range of investment strategies. The loan amount in fix and flip loans is based on various factors, including the purchase price of the property, estimated renovation costs, and potential after-repair value (ARV). Private money lenders, who specialize in fix and flip loans, evaluate these aspects to determine the loan amount and terms, ensuring that investors receive sufficient financing for their renovation projects.

Reduced Documentation and Expertise You Can Trust

Red Tower Capital simplifies the loan process by requiring significantly less documentation than traditional lenders. This streamlined approach not only speeds up the process but also reduces the administrative burden on the investor. Since 2011, our expertise in the field has helped numerous borrowers achieve their real estate goals, making them a reliable partner in the fix and flip market.

Empowering Your Real Estate Dreams

The impact of fix and flip loans on the renovation market cannot be overstated. They not only provide the necessary capital but also offer the flexibility and speed required in the fast-paced real estate market. Red Tower Capital’s Fix and Flip Loan Program exemplifies the best of what these loans have to offer - empowering investors to turn their real estate dreams into profitable realities.

Conclusion

In conclusion, fix and flip loans are more than just financial instruments; they are catalysts for growth and success in the real estate market. As we witness an ever-evolving landscape, these loans will continue to play a crucial role in shaping the future of property renovation and investment. For those looking to explore this avenue, Red Tower Capital’s Fix and Flip Loan Program offers an excellent starting point.

.svg)