Table of Contents

Hey there! Are you thinking about diving into the exciting world of real estate flipping but feeling a bit unsure about financing?

Well, you might have heard about hard money loans, and let us tell you, they can be a game-changer.

Let's break down why these loans are such a hot ticket in the flipping world, especially for those who may not be familiar with all the financial jargon.Quick Cash, Fast Projects

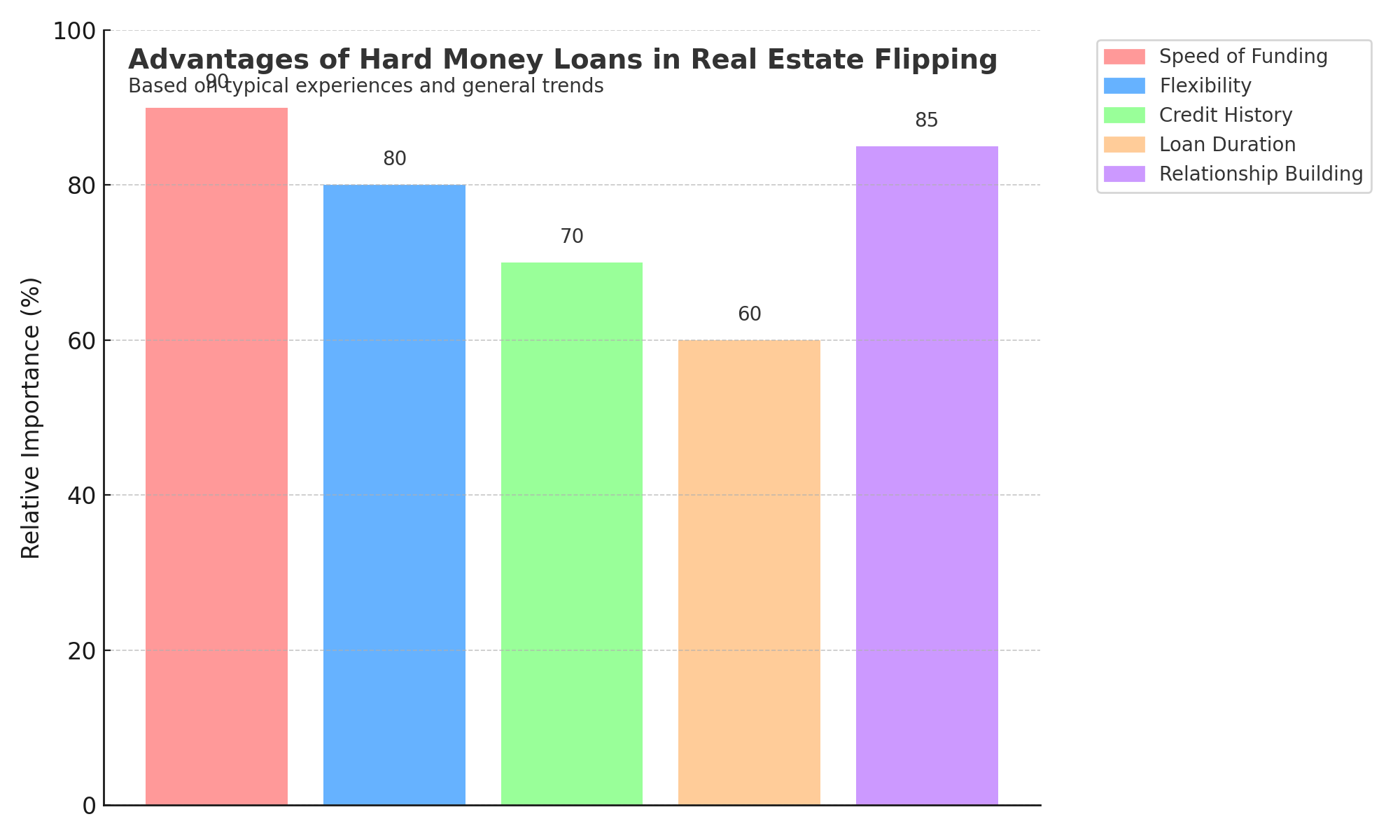

First off, hard money loans are really fast when it comes to getting you money. Traditional bank loans can take months with all their paperwork and strict lending requirements. But hard money lenders? They’re more interested in the property you’re flipping than your credit score or income. This means you can get that cash fast, often in just a few days. Speed is crucial in real estate flipping, where snapping up good deals and completing projects quickly can mean bigger profits.

Flexibility is Key

Here's another cool thing: flexibility. Hard money loans are typically issued by private investors or individuals, not big banks. So, they can be more flexible with their terms and requirements. This can be a lifesaver, especially if you've got a unique situation or a property that doesn't fit the traditional mold.

Credit History? No Biggie

Worried about your credit history? With hard money loans, it's less of an issue. These loans focus more on the property's value and potential rather than your credit score. It's perfect for flippers who might not have a perfect financial past but have a great eye for potential in properties.

Short-Term Magic

Hard money loans are usually short-term, ranging from a few months to a couple of years. This aligns perfectly with flipping, where you're in the business of buying, renovating, and selling quickly. You don’t want a 30-year loan for a house you plan to sell in six months, right?

Building Relationships

When you work with a hard money lender, you’re not just getting a loan; you’re building a relationship. These lenders often specialize in real estate investing and can offer valuable advice and connections. This can be incredibly beneficial, especially if you're new to flipping.

The Bottom Line

Sure, hard money loans can have higher interest rates and fees than traditional loans. But when you factor in their speed, flexibility, and the potential for high returns in flipping, they can be totally worth it.

So, there you have it! Hard money loans can be a fantastic tool for real estate flippers, offering speed, flexibility, and opportunities even if your credit isn't perfect.

Ready to learn more and get started on your flipping journey? Check out Red Tower Capital's Fix & Flip Loans for more info on how you can dive into the world of real estate flipping with the right financial backing.

Happy flipping!

.svg)